Advertisement

Affordable Dubai: How to Cut Costs While Enjoying the Best of the City

Dec 01, 2024

List of Europe's Top UNESCO World Heritage Sites

Oct 09, 2023

Comprehensive Guide: Understanding the Balance of Payments

Feb 17, 2025

Strategies for Success with a Limited Purpose FSA (LPFSA)

Feb 17, 2025 By Rick Novak

A Limited Purpose Flexible Spending Account (LPFSA) is a valuable tool that can help you save money on eligible healthcare expenses. It's designed to work alongside your regular healthcare FSA or HSA, offering a tax-advantaged way to pay for specific medical costs. LPFSAs are often offered by employers as part of their benefits package, and understanding how to use them effectively can make a significant difference in managing your healthcare expenses. In this guide, we'll explore how to use a Limited Purpose FSA to your advantage, making the most of the benefits it provides.

Eligibility and Enrollment

Eligibility for a Limited Purpose FSA (LPFSA) involves determining whether you meet the criteria set by your employer and tax regulations. This typically includes having a high-deductible health plan (HDHP) and being eligible to participate in your employer's benefits program. To utilize an LPFSA, you must enroll during the open enrollment period designated by your employer, ensuring you complete the necessary forms and make your contribution elections within the specified timeframe.

Contribution Limits

Contribution limits for a Limited Purpose FSA (LPFSA) are governed by IRS regulations, which determine the maximum amount you can contribute annually. It's crucial to comprehend these limits to avoid overcontributing and incurring tax penalties. Once you've grasped the IRS guidelines, you can make an informed decision regarding the specific amount you wish to contribute to your LPFSA based on your anticipated eligible expenses and financial situation.

Qualified Expenses

Qualified expenses within a Limited Purpose FSA (LPFSA) encompass specific medical costs such as dental, vision, and preventive care. Familiarizing yourself with these covered expenses is crucial for effective utilization. Additionally, understanding the IRS guidelines and restrictions on qualified expenses ensures compliance with tax regulations, as some medical expenditures may not be eligible for reimbursement, making it essential to differentiate between covered and non-covered items.

Funding Your LPFSA

Determine how you will fund your LPFSA.

To begin, assess your anticipated dental and vision-related expenses, which are eligible for LPFSA coverage. This can include costs for eye exams, glasses, contact lenses, dental check-ups, and orthodontics. Consider your past expenses and any upcoming procedures. Ensure that your projected contributions do not exceed the IRS-set annual limit, which was $2,750 for Health FSAs as of my last update in September 2021.

Set up automatic payroll deductions or manual contributions.

- Automatic Payroll Deductions: Contact your HR or benefits department to express your intention to contribute to your LPFSA. Specify the amount you want to deduct from each paycheck, ensuring it adheres to annual limits. Your employer will typically provide the necessary forms or an online portal for managing contributions.

- Manual Contributions: If automatic deductions are not feasible or your income is irregular, explore options for manual contributions through your FSA administrator and employer. They can guide you on methods like bank transfers or mailing in contributions

Using Your LPFSA

To effectively use your Limited Purpose Flexible Spending Account (LPFSA), it's crucial to keep track of your balance to prevent over- or under-contributing. Accessing funds for qualified expenses typically involves submitting claims and related documentation to your plan administrator, who will review and approve eligible expenses for reimbursement, often through checks or direct deposit. Some LPFSAs offer debit cards for immediate spending at eligible merchants, but it's important to retain receipts for record-keeping and possible audit purposes. Always refer to your plan documents and employer for specific guidelines on eligible expenses and deadlines, ensuring you maximize the benefits of your LPFSA.

Planning and Managing Expenses

To effectively plan and manage your Limited Purpose Flexible Spending Account (LPFSA), develop a comprehensive strategy to maximize its benefits, keeping in mind both your current and future healthcare expenses. This involves diligently retaining receipts and records for all qualified medical costs, and ensuring accurate documentation for claims and potential audits. Additionally, make wise and timely use of your LPFSA funds to avoid forfeiture at the plan year's end, aligning your spending with your estimated healthcare needs and the annual contribution limits set by the IRS. By proactively managing your LPFSA, you can optimize your pre-tax healthcare dollars and make the most of this valuable financial tool.

Plan Year and Grace Period

It's essential to stay informed about the plan year of your Limited Purpose Flexible Spending Account (LPFSA) to align your financial planning with its specific timeframe, typically following your employer's benefits schedule. Additionally, you should be aware of any grace period or rollover provisions your employer offers, which can extend the usability of remaining funds from the previous plan year or permit a limited rollover, helping you maximize the value of your LPFSA while adhering to IRS guidelines. Staying informed about these aspects enables you to effectively manage your healthcare expenses and avoid losing unspent funds.

Closing Your LPFSA

As the end of the plan year approaches, it's vital to understand the process for closing your Limited Purpose Flexible Spending Account (LPFSA), which may involve any remaining balances. Be aware of the "use-it-or-lose-it" rule, where typically unused funds at year-end can be forfeited. Additionally, familiarize yourself with any carryover provisions if applicable, which may permit a limited amount of funds to roll over to the next plan year, helping you avoid losing unspent funds and ensuring you make the most of your LPFSA benefits.

Conclusion

A limited Purpose Flexible Spending Account (LPFSA) is a valuable resource for individuals and families seeking to maximize their healthcare savings. By understanding the specific expenses it covers and the rules governing its use, you can take full advantage of the tax benefits it offers. Whether it's dental, vision, or other qualified medical expenses, the LPFSA is a powerful tool to help you save money while maintaining your health and wellness. To make the most of your LPFSA, it's crucial to plan ahead, keep meticulous records, and consult with your HR department or benefits administrator whenever you have questions. With the right approach, you can enjoy the peace of mind that comes from knowing you're managing your healthcare expenses wisely while saving on taxes.

Guhantara Resort Bangalore Day Out: All You Need To Know

Dec 20, 2023

Grab your Guhantara Resort tickets and explore this beautiful place. It has a lot of fun activities like swimming, gaming, art, spa, and more. The accommodation is comfortable and relaxing, and the food is mouthwatering

Strategies for Success with a Limited Purpose FSA (LPFSA)

Feb 17, 2025

Discover effective ways to leverage a Limited Purpose FSA (LPFSA) for healthcare expenses. Learn how to make the most of this savings tool.

Miami, Florida: What To Do In One Day

Dec 24, 2023

A spike in temperature is imminent. Even a short visit to Miami will leave you with lasting memories. This city has become a famous tourist destination due to its many clubs, beaches, and parties, so if you're looking for a vibrant and interesting place to spend your holiday, go no further. While the area's nightlife is its most prominent feature, visitors will find a wealth of additional options

Top 7 Best Spots To View The Northern Lights In 2022

Oct 11, 2023

The aurora borealis, often called its Northern Lights, is one of nature's greatest spectacular shows and is best seen in the winter from sites close to the North Pole. You can see the light display from some of the top vantage points listed below.

Top 10 Places to Visit in the USA in the Spring

Oct 31, 2023

The United States is a wonderful destination to explore during the spring season. From coast to coast, there are plenty of amazing activities and attractions to enjoy.

Top Lesbian Travel Destinations

Jan 03, 2024

From cosmopolitan cities to beach resorts, discover the best spots for unforgettable lesbian adventures. Learn our top picks and expert tips about making your travel experience extraordinary!

>8 must-visit forts in and near Chandigarh

Jan 04, 2024

Find in depth information about the 8 must-visit forts in and near Chandigarh including location etc

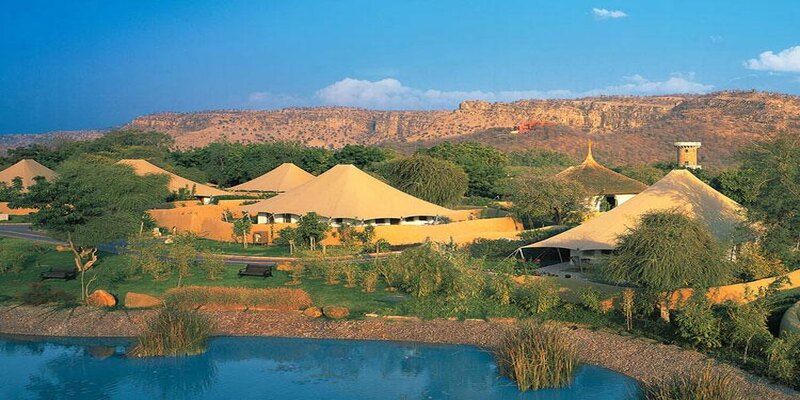

Explore the Wild in Comfort: Top Wildlife Resorts in India

Oct 08, 2023

Experience the best of luxury at the top wildlife resorts in India! Explore opulent tents in Ranthambore, family-friendly havens in Kabini, and more. Start your wild adventure now!

best place to see the Northern Lights in the United States

Feb 21, 2024

Dreaming of seeing the majestic northern lights? Get professional tips on the best places to visit in Alaska and learn why this small town is a must-see!